This loan is designed to help with short term, immediate financial needs. It could be considered a costly form of credit and may not be the best long-term solution for your personal situation. Make sure you understand the loan terms and can repay on time.

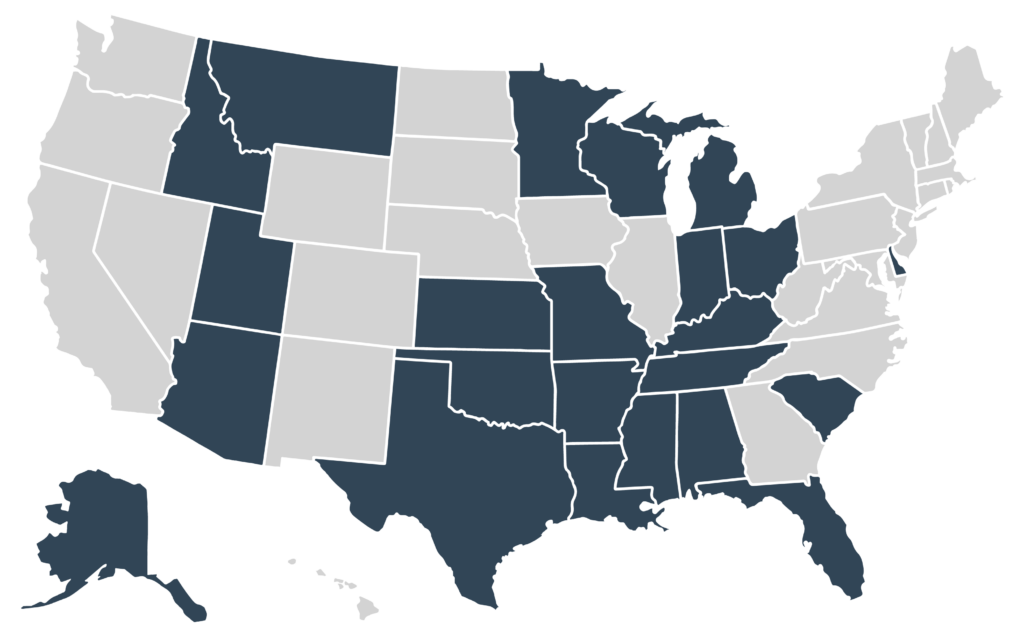

In AK, AR, AZ, FL, IN, KS, KY, LA, MI, MN, MT, OH, OK, SC, TN and TX, loans are provided by Capital Community Bank (or by one of its affiliates or divisions), a Utah Chartered bank, located in Provo, Utah, Member FDIC. All loans funded by Capital Community Bank (or by one of its affiliates or divisions) will be serviced by Balance Credit.

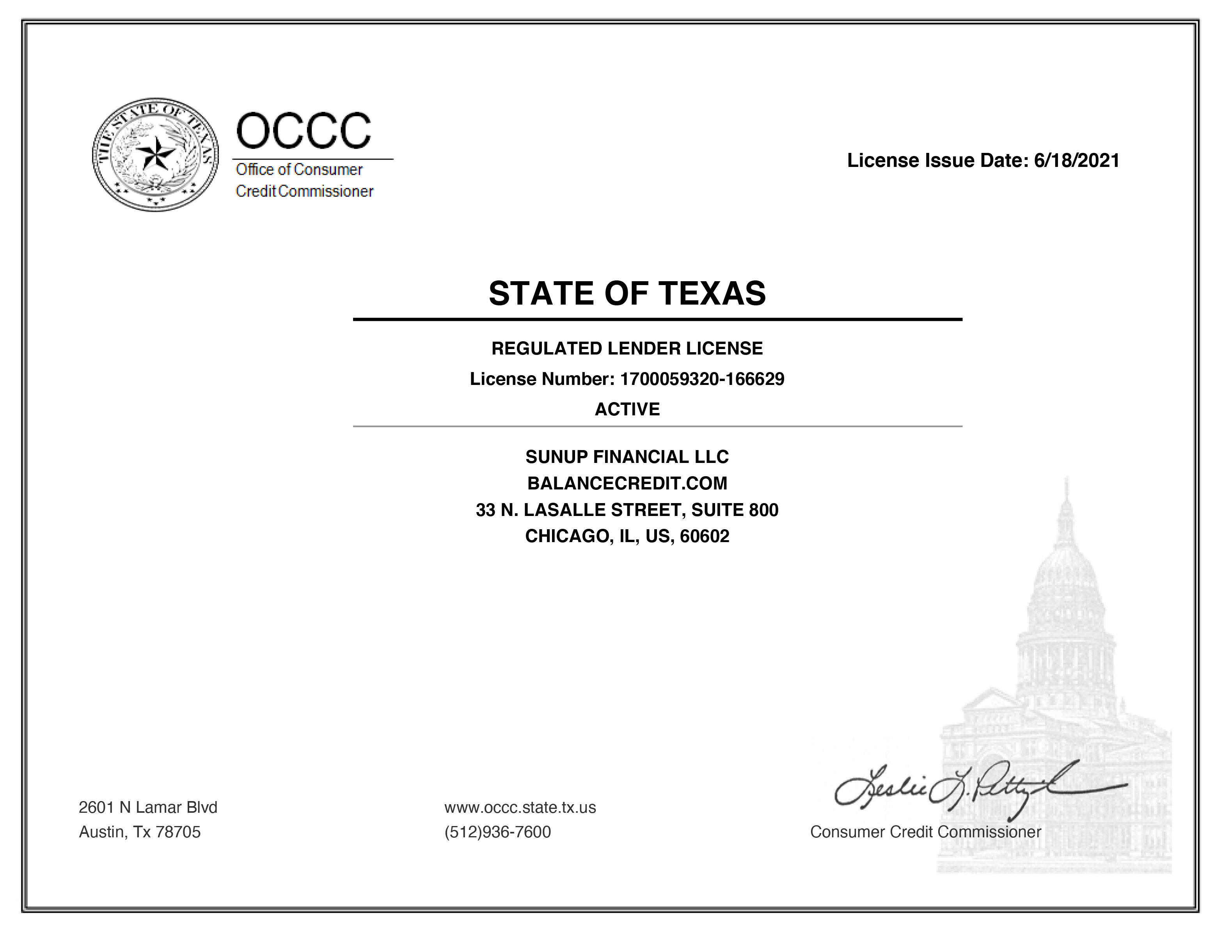

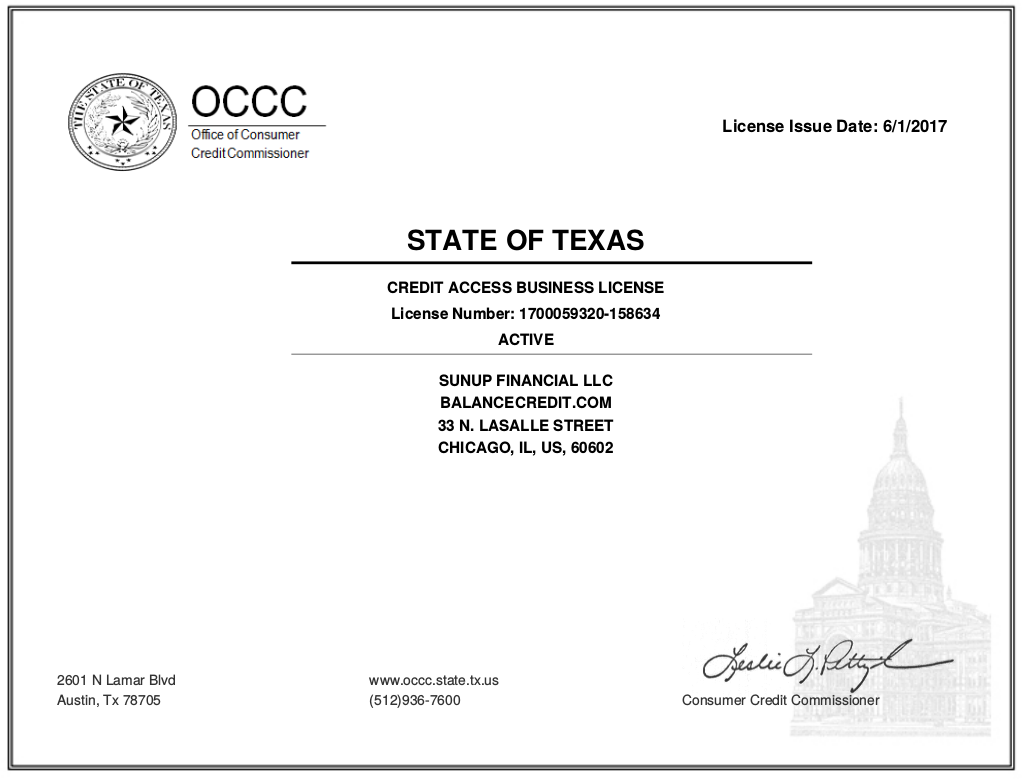

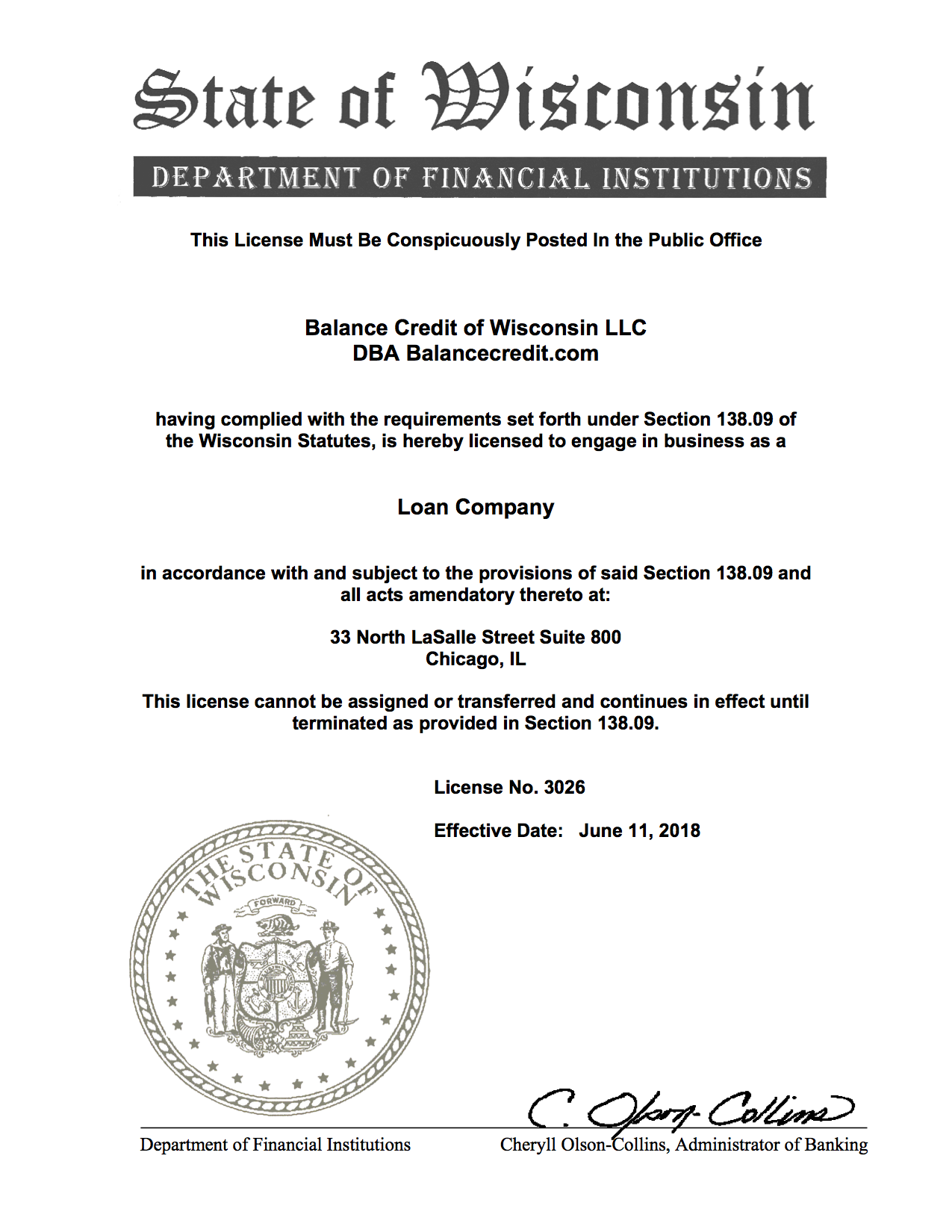

SunUp Financial, LLC, NMLS number 1331747.

AL Residents: Loans may be provided by either 1) SunUp Financial, LLC (License No. MC22640), or 2) Capital Community Bank (or by one of its affiliates or divisions), a Utah Chartered bank, located in Provo, Utah, Member FDIC. Your loan agreement identifies your lender.

DE residents: SunUp Financial, LLC is licensed by the Delaware State Bank Commissioner, License No.024137, expiring December 31, 2025.

* Rates & Terms vary by state. Balance Credit is not a lender in all states. Not all applications are approved.

** APPROVAL: In some cases, the decision may take longer; some customers applying for Balance Credit or third-party products may be required to submit additional documentation to verify application information. FUNDING: Applications processed and approved before 6 PM CT on business days and prior to 4:00 PM CT on Sundays are typically funded the next business day.

Customer testimonials and ratings reflect the individual’s own opinions and are not necessarily representative of all experiences.

USA PATRIOT ACT NOTICE: IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

©2025 SunUp Financial, LLC.